You ought to discover this value on the earlier period’s stability sheet and carry it over to the new stability sheet from the top of the final period. The inventory value is determined by the costing, or inventory valuation methodology. Ending stock is directly associated to the total value of products bought during an accounting period. FIFO stands for “First In, First Out.” It is an accounting technique that assumes the inventory you purchased most just lately was bought first. Utilizing this method, the value of your most recent stock purchases are added to your COGS earlier than your earlier purchases, that are added to your ending inventory. FIFO is an accounting methodology that assumes the inventory you bought most recently was sold first.

- If your stock ranges are less than they want to be, this might be a sign of stock shrinkage as a end result of accounting error, theft, or a wide selection of other issues.

- Regardless of the dimensions of your small business, you should perceive the methods used for calculating ending inventory.

- From time to time, I will invite other voices to weigh in on necessary points in EdTech.

Ending Stock is valued on the Balance Sheet utilizing the sooner costs, and in an inflationary setting, LIFO ending Inventory is less than the present cost. Thus in an Inflationary environment, i.e., when prices are rising, they will be decrease. Use turnover ratio evaluation to set appropriate reorder ranges and keep away from extra stock.

Leveraging this information ensures the right merchandise are in stock on the proper time, optimizing stock ranges. Regularly evaluating calculated ending inventory with bodily counts identifies shrinkage brought on by theft, damage, or errors. Accurate ending inventory calculations are very important for producing reliable monetary statements that reflect the company’s true monetary situation, guaranteeing investor confidence. Inaccurate stock can result in tax points, misreported earnings, and poor decision-making. The Ending Stock formula refers to the mathematical equation that helps calculates the worth of goods available for sale at the end of the accounting interval.

They impact monetary statements, guarantee regulatory compliance, and assist production and sales. Record compute the cost assigned to ending inventory all inventory purchases and the production prices of products made in the course of the period. Purchases should embrace raw materials, finished goods, or work-in-progress items added into inventory and able to promote. They are used to calculate the whole stock obtainable for sale or use.

Step 2

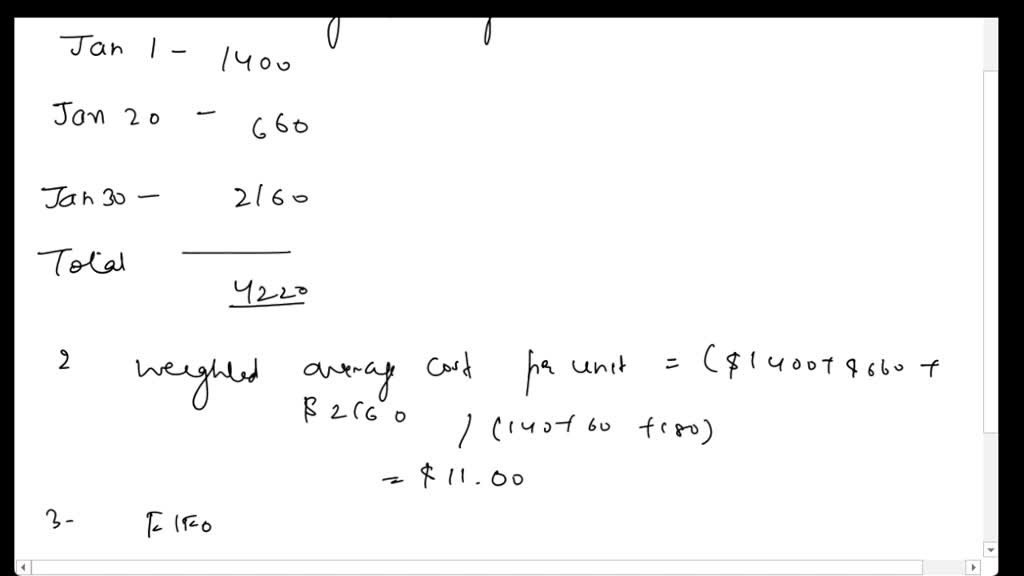

To determine the price assigned to ending stock and to price of products bought using FIFO, Weighted Average, and LIFO, we need to comply with the respective inventory costing strategies. Here are a variety of the commonest questions ecommerce companies have in relation to calculating ending inventory. Beneath the FIFO method, we will use the oldest stock at the time of the sale first. There are a few methods you can do them – there is an Inventory Report or a shortcut calculation.

Company

However, this technique also can result in lower reported earnings, which could not at all times be favorable for monetary reporting. Calculating ending stock utilizing the FIFO technique enables businesses to take care of an accurate and up-to-date report of their inventory worth. Following these steps will permit you to effectively manage your inventory, making certain that your financial information are exact and help improve general enterprise operations. Complete cost of goods bought for the month would be $7,200 (4,000 + three,200). Since total Gross Sales would the same as we calculated above Jan 8 Sales ( 300 units x $30) $9,000 + Jan eleven Gross Sales (250 units x $40) $10,000 or $19,000.

Starting balance is calculated from the earlier reporting period’s ending steadiness. Due To This Fact it’s crucial that the proper ending inventory is calculated appropriately in your balance sheet. You wish to make positive that the figures in your stock balance sheet match up with what’s currently in your warehouse. Knowing your ending inventory verifies the inventory that you’ve recorded matches the actual physical stock you’ve readily available. If your stock ranges are lower than they should be, this could probably be an indication of stock shrinkage due to accounting error, theft, or a variety of other issues.

It is an asset on the steadiness sheet and instantly impacts COGS and profitability. Incorrectly calculated stock has tax implications and will lead to financial penalties. Frequently assess your stock ranges and use inventory management software program to optimize your inventories. Correct ending inventory calculations require greatest practices like regular bodily inventory counts, constant valuation strategies, and utilizing stock administration software. In conclusion, understanding and precisely calculating ending inventory is prime for any enterprise coping with physical products.

To calculate the ending inventory value, multiply the remaining unsold models with their respective unit costs, according to the FIFO methodology. Ending Inventory is the value of products or products that stay unsold, or we can say that remains on the end of the reporting period (Accounting period or monetary period). It is always https://www.personal-accounting.org/ based available on the market worth or price of the goods, whichever is lower.

We plan to cowl the PreK-12 and Larger Education EdTech sectors and supply our readers with the most recent news and opinion on the topic. From time to time, I will invite different voices to weigh in on essential issues in EdTech. We hope to provide a well-rounded, multi-faceted look at the previous, present, the future of EdTech within the US and internationally. Do the ending stock Calculation under the LIFO, FIFO, and Weighted Average Cost Method.